Olive Oil Production Data in Europe Reveal Divergent Trends

Production in Italy and Greece is down sharply. In Spain and Portugal, it's dramatically higher.

Olive oil production in Spain and Portugal has been consistently increasing over the past 15 years, with both countries achieving record harvests last year. In contrast, Italy and Greece have experienced diminishing yields at a similar rate, possibly due to shared traditional farming systems and the impacts of climate change. While Spain and Portugal have seen growth due to investments in infrastructure and modernization, Italy and Greece may need to shift their focus to quality production to combat downward trends in production.

Olive oil production is trending in different directions in two European regions.

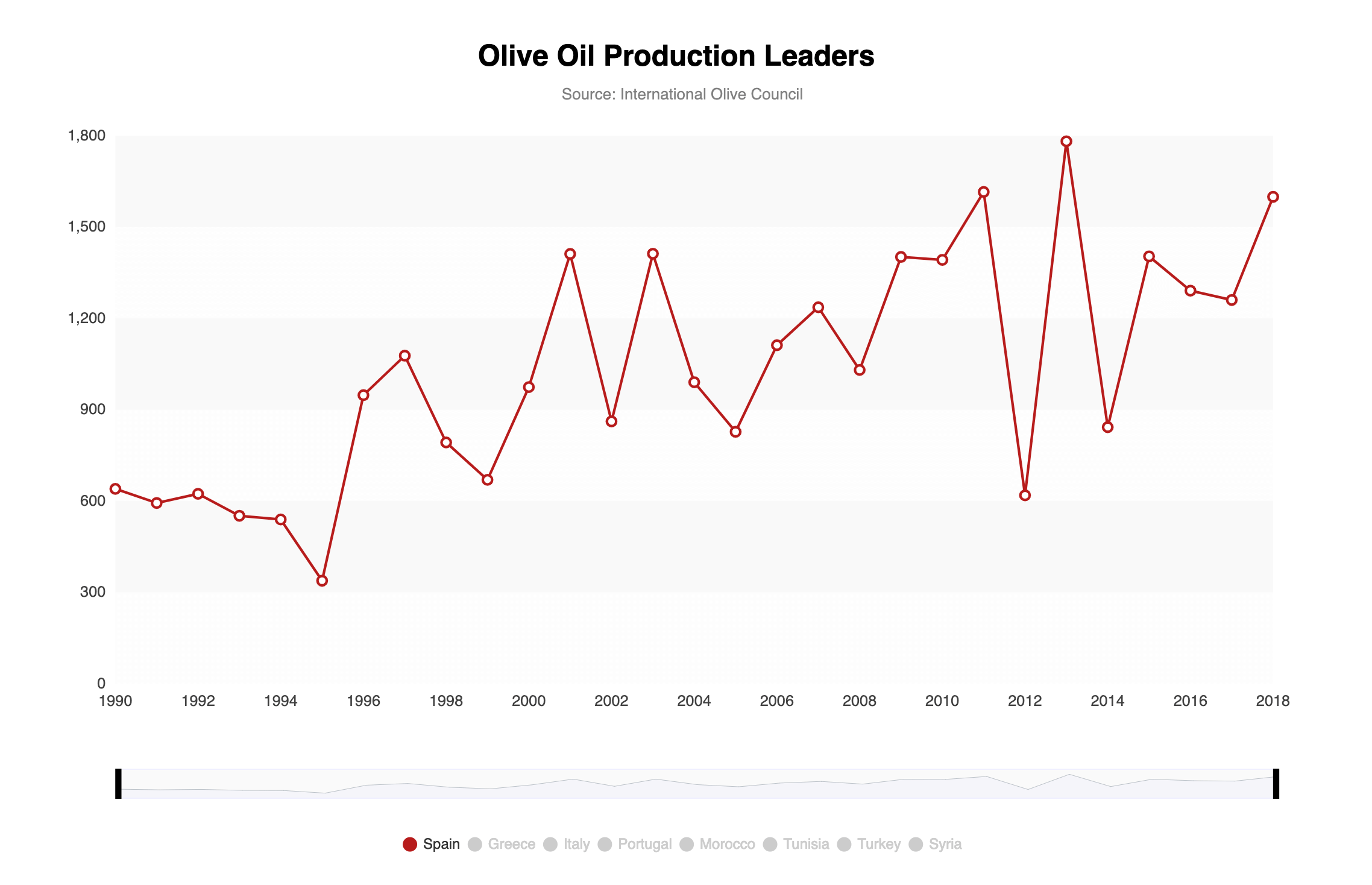

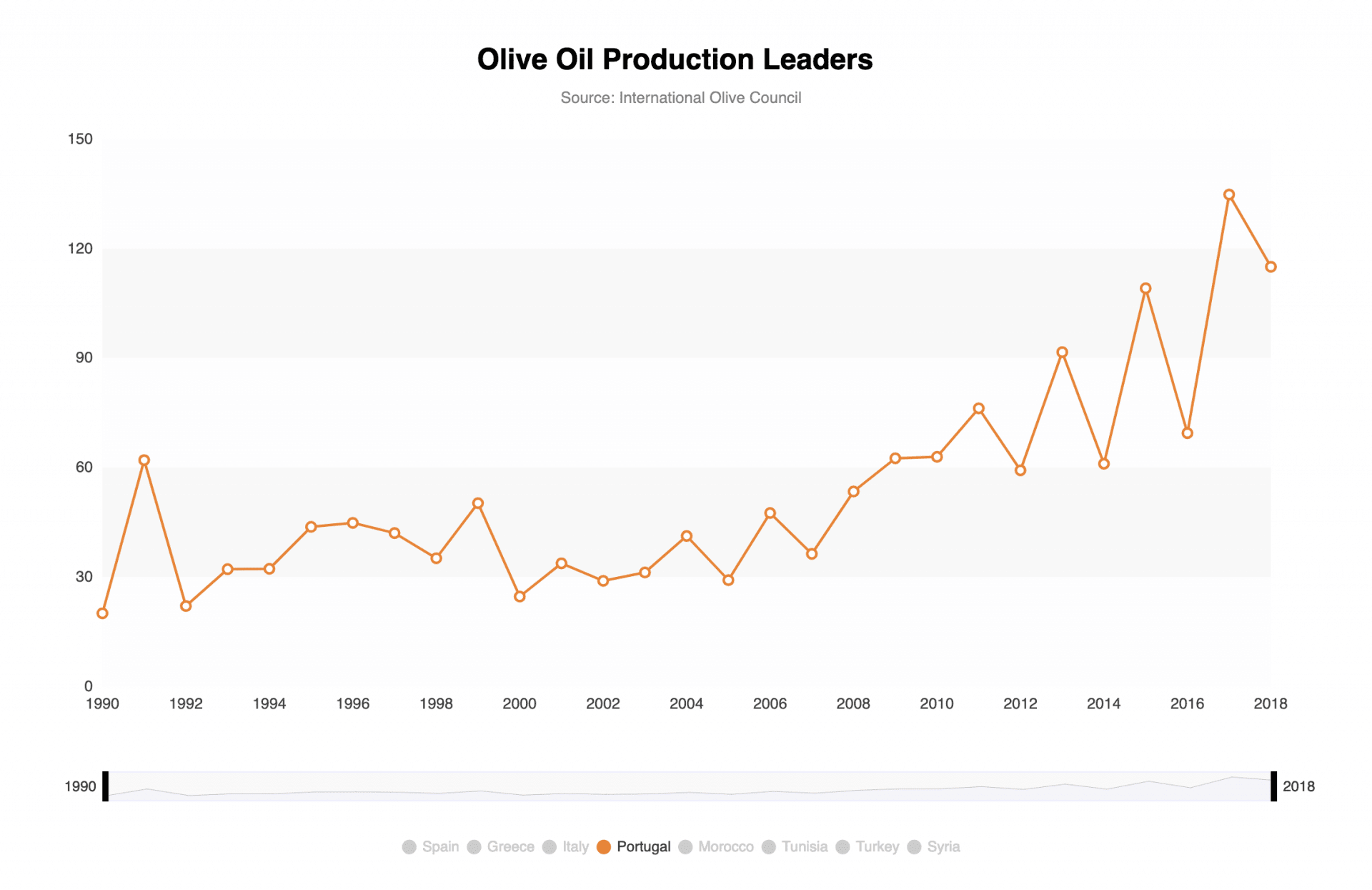

On the Iberian Peninsula, Spain and Portugal have seen their olive oil harvests continuously grow to record levels over the past 15 years.

The sector gained a boost in both (Spain and Portugal) by a favorable environment for investments to create infrastructure and the modernization of olive groves.

Last year, both countries enjoyed excellent yields, with Spain producing 1,598,900 tons and Portugal producing 115,000 tons. These respectively represent the third- and second-best harvests the countries have ever had.

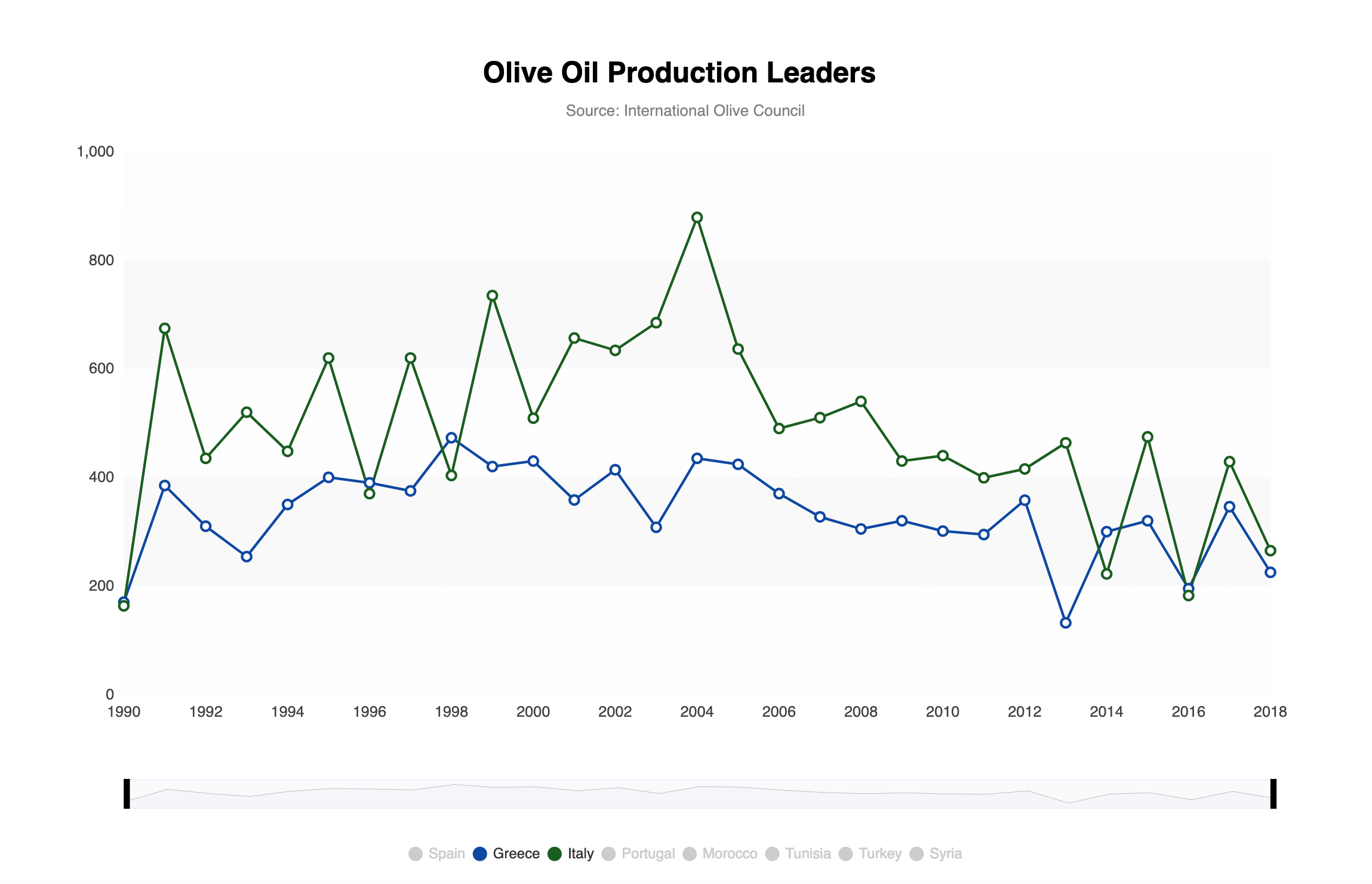

Meanwhile, on the other side of the trading bloc, Italy and Greece have both seen annual yields continue to diminish over the same period of time and at a stunningly similar rate.

Italy produced 265,000 tons, which is the country’s third smallest yield in more than a decade. In Greece, only 225,000 tons were produced, which represents their third worst harvest in the past decade as well.

This trend could be due to similar traditional olive farming systems shared by (Italy and Greece).

Several factors are impacting production across these four countries, but climate change may be one of the biggest. According to multiple meteorologists interviewed for this article, the region will continue to get hotter and drier, in general, with more sporadic episodes of intense cold and intense rain at varying times of the year.

“In principle, climate warming, in the Mediterranean area, will mean, not only the increase in temperatures but above all the loss of regularity in atmospheric times,” Jorge Olcina, the head of the University of Alicante’s climate institute, told Olive Oil Times.

See Also:Olive Oil Production News“This means that we will have more intense and abrupt changes of weather, with hot days, followed by sudden temperature drops; droughts of short duration but intense, punctuated by episodes of torrential rains,” Olcina added. “And this will manifest itself in both the eastern and western sectors without fixed periodicity.”

Kostas Liris, a Greek agronomist and olive oil expert, agreed that similar weather patterns, specifically similar patterns of bad weather in recent harvest years, have played a role in the downward trends of both Greek and Italian olive oil production.

“The general climate conditions affect a lot the production and between Italy and Greece, we have a lot of similarities,” he told Olive Oil Times. “The south of Italy and Greece share the same weather, which naturally has to do with the production and the quality of the oils produced. When there is a lot of cold or even snow in Italy, after two to four days we have similar weather in Greece.”

The same pattern applies for hot weather and conditions of drought as well.

Giovanni Bianchi is the producer of 2016 NYIOOC Best in Class Argali and harvests olives from groves in Peloponnese, which is located in southern Greece. He told Olive Oil Times that recent climatic conditions have impacted his harvest and he believes these same conditions are affecting other producers in both Italy and Greece.

“My olive grove is located in Gargalianoi, in the Peloponnese, where the climate is mild, and it was, usually, dry from June to the end of August,” he said. “But in the last few years, although it does not rain, it is very humid; then, from early September, precipitation became more frequent.”

“The western coast of the Peloponnese is right across from Italy, and the weather events generally occur in accordance with what happened in southern Italy, in particular in Puglia,” Bianchi added. “Farmers in this area of Greece often check the weather forecast for that Italian region, because it frequently happens that a storm front moves from Puglia to this coastal strip within 24 to 36 hours.”

However, the second and the third largest producers in the E.U. have more in common than just connected weather.

Tullia Gallina Toschi, a professor at the Department of Agricultural and Food Sciences of the University of Bologna, told Olive Oil Times that the two countries share similar methods of cultivation and production, which may also help to explain the similarities in their trends.

“This trend could be due to similar traditional olive farming systems shared by these two countries,” she said. “Indeed, Greece and Italy are characterized by a fragmented olive oil production, managed by small farmers or even big producers, without significant development of intensive and super-intensive farming systems, which are more commonly implemented in Spain.”

“The more fragmented and traditional production of Italy and Greece, linked to many local olive cultivars and farms, and typical olive oil productions – such as PDO, PGI, monocultivar and high-quality productions – leads to higher fluctuation in the olive oil production along the years,” she added.

Farther west in Spain and Portugal the upward trend in olive oil production is less closely aligned, but nonetheless noticeably similar.

Climatic conditions may play a small role in these similarities, but overall similar production techniques and growing investments are the driving factors behind this increased production.

Jorge de Melo is the CEO of Sovena, which is one of Portugal’s largest agribusiness holding groups. He told Olive Oil Times that both Spain and Portugal have favorable investment climates, which in turn has led to improvements to olive cultivation and oil production.

“The sector gained a boost in both countries by a favorable environment for investments to create infrastructure and the modernization of olive groves,” he said. “The introduction of new varieties and the introduction of irrigation have led to increased productivity in the two neighboring countries.”

De Melo cited the investment in the Alqueva dam in Alentejo, which has allowed super-intensive olive groves to be cultivated in a region where they otherwise would not be, as one example of how growing investment is fueling a rise in production.

“The provision of water for irrigation in an area with good agricultural vocation was the engine for the development of modern agriculture that leveraged the Portuguese olive sector with excellent results in terms of quantity and quality of the oils produced,” he said.

Vincenzo Benevento, an experienced agronomist and independent scholar based in Calabria observed that in most cases, in the productive areas of Italy and Greece, irrigation is not systematic, and often implemented only in case of a water emergency.

“Climate and rainfall patterns are similar, or even identical, in several areas of Greece and southern Italy, which accounts for most of the national production of olive oil,” he said. “We must add to this the similarities of the cultivation techniques, also taking into account the average size of farms, as the plots are often too small to allow a streamlined phytosanitary defense program.”

“Moreover, several olive trees are secular, therefore it is difficult to change their aspect and management, which is generally based on non-systematic irrigation, fertilization, and plant health protection,” he added. “This makes the production trends of both countries, which share also a similar ratio between the utilized agricultural area and the number of plants, more susceptible to the vagaries of climate.”

Meanwhile, in Spain, the process of growing new super-intensive olive groves along with streamlining and modernizing oil mills is fueling the increasing production of the world’s largest olive oil producer.

“In Spain, there are two phenomena [that have led to the increase in production], the increase and the improvement of the productivity through irrigation systems and the cultivation of new plantations.” Juan Vilar, a Spanish olive oil consultant, told Olive Oil Times.

This improved productivity has, in turn, led to increased investment both in olive groves as well as olive mills from both foreign and domestic parties

“Instead of looking for areas to plant olive trees outside of Spain, investors are looking for places to do so in Spain,” Vilar said. “For instance, in Extremadura, nearly 62,000 acres have been planted in the last five years.”

Spain and Portugal have also benefited in recent years from different weather events that have come just when growers needed them to.

“As regards Portugal and Spain, their production increases are partially due to a good rainy year,” Rafael Pico Lapuente, the director of Asoliva, told Olive Oil Times. “In the case of Spain, it is also noteworthy that we have many medium-sized producers, with olive trees resting on alternate years, which means there can be an increase in production when the rains come.”

Barring climatic disasters akin to the ones that occurred in Italy and Greece this year – something climatologists have not ruled out – Spain and Portugal both have the potential for record-breaking harvests in the coming years, according to Vilar.

“In Spain, there is the capacity to produce two million tons if the weather cooperates,” he added. “On the other hand Portugal, in more than five years will be the fifth largest producing country in the world.”

However, without an increase of investment and shift away from rain-fed agricultural practices in Italy and Greece, Vilar predicted that production there will continue to trend downwards.

“Greece and Italy will, step-by-step, lose importance,” he said.

More difficult growing seasons across the Mediterranean are almost certain. While Spain and Portugal adapt by streamlining cultivation and milling processes, Gallina Toschi, the University of Bologna agriculture and food science professor, believes that Greece and Italy will have to shift their focus to quality of production.

Major downward fluctuations in volumes have not been matched by a loss of quality in either of the two countries, according to data from the NYIOOC. In fact, Italy and Greece have continued to improve the quality of their olive oils, particularly over the past two years, which can be seen in the steady increase of overall awards as well as Gold and Best in Class awards that producers have received.

“In terms of quality, I can say that our panel analyzed and evaluated excellent extra virgin olive oils, diversified in taste, extremely fragrant and particularly rich in polyphenols,” Gallina Toschi said.