Lebanese olive oil production is expected to reach 26,000 tons in the 2020/21 crop year, according to the latest data from the International Olive Council.

While this figure is not too much higher than the rolling five-year average (23,500 tons), a shift is beginning to take place in the sector.

To survive the financial crisis, and given that a large part of the cost is in U.S. dollars, every sector is looking at means to export its products. This also applies to olive oil.

Since August 2019, Lebanon has found itself in the midst of a severe financial crisis, compounded by political instability, American sanctions on neighboring Syria and the COVID-19 pandemic.

Rampant devaluation of the Lebanese pound, which has lost 80 percent of its value compared with the dollar, and a severe shortage of dollars have increased producers’ costs.

See Also:Mystery Behind High Lebanese Olive Oil Prices Solved“Any treatment has become unbearable and without the support of the government, we worry for the 2021 harvest,” Ibrahim Al Kaakour, the owner of Genco Olive Oil, told Olive Oil Times. “We think the lack of support will entail an inability to purchase the needed material and thus make us lose five years of work and treatment.”

“Importing packaging from abroad to sell products locally has been a disaster as foreign currency has become scarce and maintaining high-end packaging is no longer a feasible and affordable privilege for any brand,” he added.

According to a report from the Food and Agriculture Organization of the United Nations, Al Kaakour is not alone. The FAO said that many farmers in Lebanon require liquidity and recommended that the government allow farmers to import goods at an adjusted exchange rate.

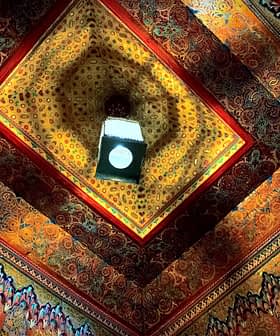

Youssef Fares

A similar offering is available to the manufacturing sector and has also been used with limited success to import medical equipment during the pandemic. However, a gridlocked government and bloated bureaucracy have limited this strategy’s effectiveness in the medical sector. If it were made available to farmers, it is hard to tell how effective it would be.

Due to the lack of government support, exporting olive oil is becoming more of a necessity as it brings much-needed harder currencies into the county, which can be used to pay off producers’ expenses.

“To survive the financial crisis, and given that a large part of the cost is in U.S. dollars, every sector is looking at means to export its products,” Youssef Fares, the general manager of House of Zejd, told Olive Oil Times. “This also applies to olive oil with the limitation that the price of olive oil in Lebanon is higher than in other producing markets.”

“In our case, and ever since 2007, we have been largely focusing on exporting our brand Zejd, where we are witnessing more traction since the local currency devaluation made our prices more competitive,” he added.

Al Kaakour, who founded Genco Olive Oil four years ago with the primary goal of exporting olive oils, has also noticed that the currency crisis has made Lebanese oils more competitive on the international market.

“The economic situation simply enforced our [export] strategy and gave other producers and us in Lebanon a better edge due to the devaluation of the national currency as prices are more competitive now compared to other countries.”

However, the Lebanese liquidity crisis goes far beyond a shortage of harder currencies to import goods. Part of the problem comes from the country’s banking crisis.

Youssef Fares

Last year, thousands of Lebanese depositors woke up to the painful reality that their savings were gone, frozen by an indebted central bank that was seeking to fund the country’s ballooning deficit.

“The financial crisis has affected the company and me. I do not have access to my savings in the bank, so practically, the cash flow is not available,” Rose Bechara, the owner of Darmmess, told Olive Oil Times.

“I had to borrow the money to do the harvest and cover all expenses of fixed assets, operational costs, costs of good and everything,” she added. “Hopefully, we can make a profit and return the money.”

Bechara is in her second year of olive oil production in the southeastern town of Deir Mimas, which is known as the Bordeaux of olive oil. She said that Darmmess had already sold nearly three-quarters of its production, of which 85 percent was exported.

Despite the financial crisis, she said that extra virgin olive oil producers benefited from selling a niche product.

“Given that it is a niche product, your target market will always pay for it, whether or not the local market or export markets,” she said. “Lebanese olive oil is some of the best in the world. We need to learn how to market it to make it grow and to position it the right way.”

Bechara added that she only exports her highest-quality extra virgin olive oils, which are now too expensive for most Lebanese people, half of whom live below the poverty line.

However, she said that lower quality extra virgin olive oils remain a staple in the country and the market for those is still strong.

While a financial bailout for Lebanon’s producers remains an unlikely prospect, Fares believes there are other measures the government could pass to help producers export their olive oils.

“In the absence of any financial means left to support producers under the financial crisis, one could only expect the government to at least act on valorizing our offering by passing some regulations, such as a geographic indication law that would create some product differentiation on the international level; or accrediting a laboratory for organoleptic assessment of virgin olive oil,” he said.

However, Al Kaakour is not holding his breath for this day and concluded that Lebanese producers are a bit like the trees they tend in the endemic home of olive.

“Our ancestors have been harvesting and milling olive oil in Lebanon for more than 6,000 years,” he said. “I am sure many have gone through worse situations than nowadays yet they still persisted. We will not give up either.”