U.S. Olive Oil Imports Are Increasingly in Bulk

Import trends suggest a dramatic change in the ways olive oil reaches American end users and the successful transition by Spain and others toward marketing their national brands to foreign buyers.

Freighter off Valencia, Spain

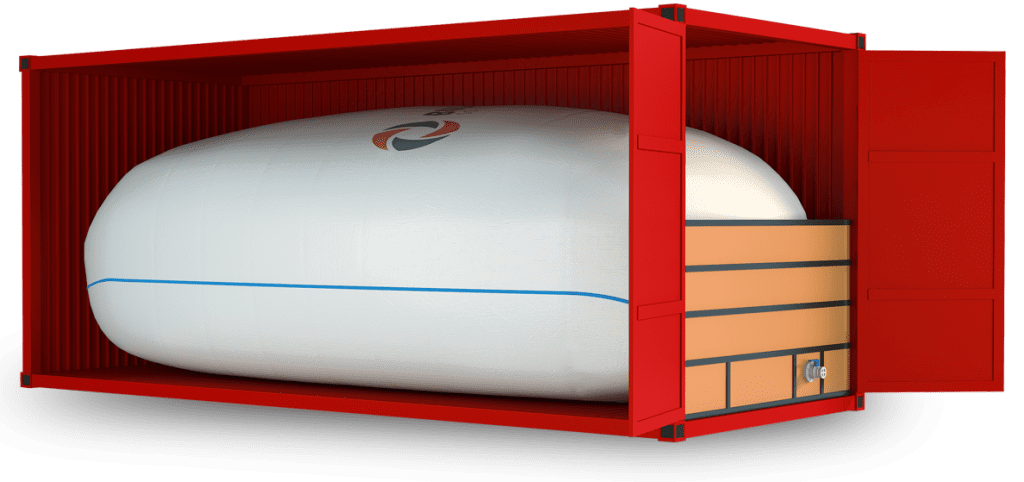

Freighter off Valencia, SpainTen years ago, a mere 16 percent of the 113,000 tons of olive oil imported to the United States was in bulk containers. This past year, more than 42 percent of the 331,368 tons of imports were in bulk, defined as full containers weighing more than 18 kg (39.7 Lbs).

The figures, released today by the International Olive Council (IOC), reflect the rising popularity of olive oil and an ongoing change in the way the world’s largest market is dealing in the commodity.

Bulk container imports are destined for U.S. bottlers of private label and mass-market brands, foodservice suppliers, and even domestic producers who supplement their limited inventories with the abundant supply from Europe and North Africa, and especially Spain. For example, Veronica Foods, the California distributor of hundreds of specialty stores around the country imports and ships to its retailers in bulk containers, and California Olive Ranch, the largest American olive oil producer has also begun importing oils from abroad to complement its range of home-grown products.

Spain accounted for 62 percent of bulk imports last year, while Italy’s share of the surging large container market was just 4 percent. Tunisian olive oil represented 14 percent, Morocco produced 7 percent and Argentina and Chile supplied 5 percent and 3 percent of the bulk imports respectively.

Meanwhile, Italy is not the powerhouse it once was for smaller containers either. Ten years ago, Italy accounted for two-thirds of olive oil imported in bottles and tins; today its market share in the category has slipped to one-third.

Spain, which supplied just 9 percent of the small container market ten years ago now accounts for 25 percent, according to the IOC figures. Other countries creeping in on the segment once dominated by Italy include Tunisia and Greece.

The data suggests a dramatic change in the way olive oil reaches American end users and the successful transition by Spain, the world’s largest olive oil producer, and to a lesser degree Tunisia, from shipping their yields to Italy to be blended and repackaged as Italian olive oil, toward marketing their own national brands to foreign buyers.

The trends also reflect a growing commitment to quality among the leading producing countries and perhaps, at least to some degree, the negative publicity, deserved and otherwise, that the Italian olive oil industry has suffered in recent years.

Consumers and food industry professional alike are becoming increasingly aware that olive oil quality transcends national boundaries. Yet with the emergence of white-label distribution and private brands, the onus will increasingly fall on domestic distributors and merchants to assure the authenticity of their own branded products.