Tensions Increasing Between World's Two Largest Producers of Sunflower Seed Oil

Ukraine and Russia account for over half the world's sunflower oil production. As military tensions escalate between them, the marketplace for sunflower and other cooking oils may be affected.

Russia and Ukraine are the world’s largest producers of sunflower seed oil, with production steadily increasing since the fall of the Soviet Union. Military tensions between the two countries may impact the marketplace for sunflower and other cooking oils, with potential consequences for the industry and consumers worldwide.

Since the fall of the Soviet Union, Russia and Ukraine have been locked in a quiet competition to outproduce the other in sunflower seed oil. As a result, the two countries are now the largest producers in the world. However, as military tensions escalate between them, the marketplace for sunflower and other cooking oils may be affected.

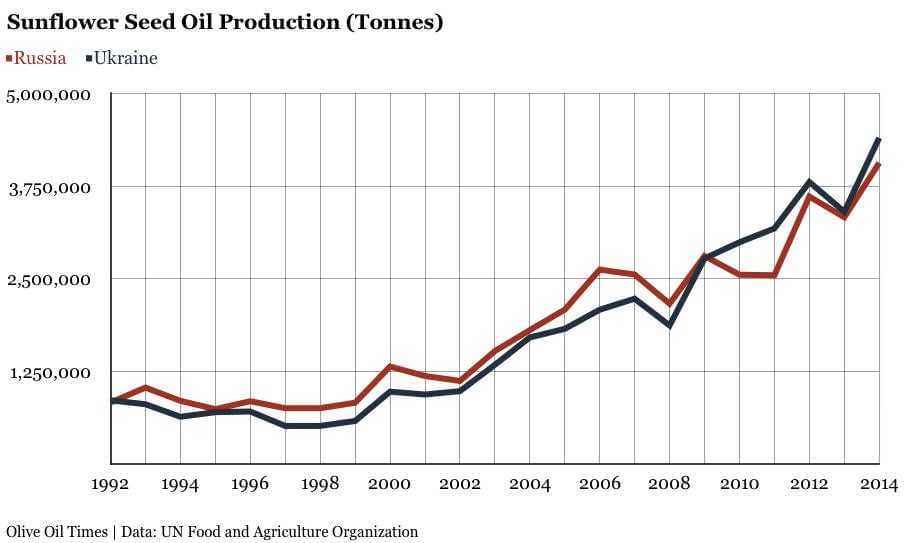

According to the Food and Agriculture Organization of the United Nations (FAO), sunflower seed oil production in the Russian Federation has increased from 827,000 tonnes in 1992 to over 4 million tonnes in 2014. Over the same period, Ukraine has increased its production from 857,000 tonnes to over 4.4 million tonnes. Argentina was the third largest producer in 2014 at roughly 932,000 tonnes.

Together, Russia and Ukraine account for over half the world’s sunflower seed oil production. Any disturbances in these two economies could have far-reaching ramifications in the cooking oil industry, including olive oil.

Following the annexation of Crimea in 2014, military tensions have been simmering between Russia and Ukraine. A recent proposal by the Pentagon and State Department to supply Ukraine with anti-tank and anti-aircraft weaponry in its fight with pro-Russia secessionists in the Donetsk region is a significant departure from the non-lethal support of recent years. The proposal for arms deliveries coincides with recent legislation that will impose sanctions on Russia’s defense and energy industries in response to Russian interference in the 2016 elections in the United States.

At present, the new Western sanctions do not cover sunflower oil exports from Russia. However, Russia may be contemplating imposing tariffs on its own sunflower exports.

In June, Russia’s Sunflower Oil and Fats Union sent a letter to the Economy and Agriculture Ministries requesting that the country raise the export tariff on sunflower seeds from 6.5 percent to 16.5 percent. It is hoped that the internal tariff would suppress the local price for sunflower seeds — the raw material used for making sunflower seed oil.

Sunflower seed prices have risen 9% in Russia since mid-May due to strong international demand. As a result, inflationary pressure is building in an economy where wages fell 9.5 percent in 2015. Rising prices and declining purchasing power begin to put basic commodities like sunflower oil out of reach for many Russian citizens.

Ukraine stands to benefit the most from any disruption in Russian cooking oil supply. Europe is the primary consumer of Ukrainian sunflower oil, importing 684,000 tonnes in 2015, or roughly one-quarter of all imports. This figure has grown in recent years, aided in part by the lifting of import tariffs on Ukrainian sunflower oil in 2014.

By 2016, the value of all vegetable oils, together with animal oils, and fats and waxes, imported from the Ukraine into Europe amounted to roughly $1.3 billion, up from roughly $770 million in 2015. However, the Ukrainian currency, the Hryvnia, is also now trading at one-third of its early 2014 value, making the price of its sunflower oil exports more attractive on international markets.

The Russian Ruble is also degraded and is currently trading at almost half its 2014 value, losing 2 percent in July alone. Low exchange rates, coupled with unseasonably cold and rainy weather, is expected to impact Russian agriculture in the months ahead. However, it is Russia’s military and diplomatic moves, particularly in relation to its neighbor, Ukraine, that will invariably affect sunflower seed oil prices the most.