European Olive Oil Exports Expected to Recover as Costs Rise

The latest short-term projections show limited growth in exports and steady production. While olive oil prices rose last year, so did production costs.

New York

New York Olive oil producers in the European Union should prepare for some ups and downs in the newly-minted 2020/21 crop year, according to the E.U. Short Term Outlook for agricultural markets.

Production in the bloc is expected to reach 2.1 million tons in the current crop year, comparable to the yields of the previous season. Exports are also likely to be similar to last crop year’s volumes.

However, the report warned that farmers should be prepared for rising operating costs. Growing inflationary pressures in the E.U. have resulted in a sharp increase in energy, raw material and shipping costs. One stark example is that of fertilizer, prices of which increased by 77 percent in the past year.

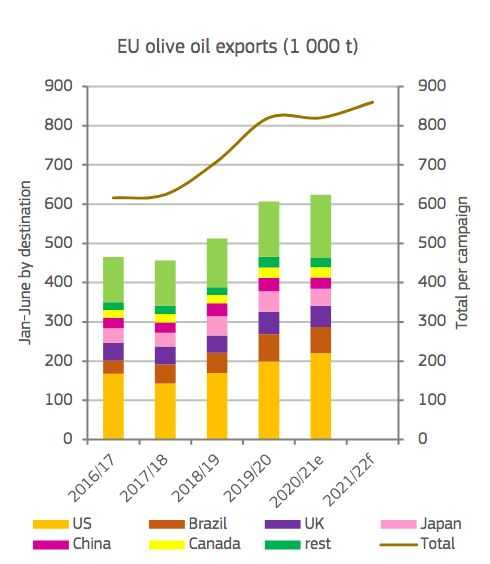

See Also:Olive Oil Trade NewsIn terms of exports, the E.U. expects to see “modest but above average” growth from the current crop year, largely fueled by increasing trade with China and the United States.

From October 2020 to June 2021, exports increased three percent compared to the same period in the previous year. Exports to the U.S. rose by four percent, which is lower than originally expected, with traded volumes slowing down in the last three months.

“This could be due to higher freight costs, some uncertainty on when retaliatory tariffs would be lifted, as well as the market opportunities lost by some exporters due to those tariffs,” said the report, referring to the long disagreement between the U.S. and E.U. over subsidies provided to their respective aircraft manufacturers, Boeing and Airbus.

However, there is optimism that exports to the world’s third-largest olive oil consumer will rebound, and overall exports will continue to grow.

“Restocking in some export destination and reopening of foodservice should contribute to higher exports, while E.U. consumption could decline due to lower availabilities and above-average prices,” the report said.

Other export destinations have seen relevant decreases due to large olive oil stocks, the foodservice sector’s slow recovery, and increasing olive oil prices.

“Therefore, 2020/21 E.U. olive oil exports could remain the same as in the previous campaign [820,000 tons],” the report stated.

E.U Short-Term Outlook

Should trade relations improve, 2021/22 exports could reach 860,000 tons and European producers could regain some market share. Reaching those levels, though, will also depend on the ability of olive oil producers to make inroads in Asia, where the olive oil market is growing.

The E.U. Short Term Outlook projections also showed that extra virgin olive oil prices in the bloc grew by four percent in the past year. This could affect consumption within the main E.U. producing countries.

“Imports are strongly decreasing with lower availabilities in non‑E.U. countries toward the end of the campaign,” the report said. “Imports could reach 160,000 tons,” which would be 40 percent less than in the previous season.

Still, given a positive price environment and a bumper crop expected in Tunisia – up to 240,000 tons – E.U. experts hint that olive oil imports in 2021/22 could rise to 200,000 tons.

Given the data on exports and the three percent growth in E.U. olive oil consumption estimated by the report, ending stocks could be slightly above the expected total of 470,000 tons, still 13 percent below the rolling five-year average.

The report also focused on the damage caused to production by the unpredictable weather, which affected the largest olive oil-producing countries in the bloc, and highlighted the increasing importance of irrigation,

“An initially expected on-year harvest in Italy and Greece was hampered by a hot and dry summer,” the report said. “Many growers suffered from water stress, which proved to be critical especially in non-irrigated production systems. This could result in lower yields.”

“In Spain, average production is expected, while in Portugal production could increase by 50 percent,” the report added. “E.U. initial availabilities would then be four percent below last campaign.”

While presenting the report, Tassos Haniotis, the European Commission’s director of agricultural strategy, simplification and policy analysis, warned that “we enter another phase of market turbulence, including factors linked to increased weather volatility [and] to climate change.”