Finding Balance in a Changing Sector Yields Success for Portuguese Exporter

Quality serves as Est. Manuel Silva Torrado’s north star as the company navigates export markets and the country’s rapidly changing sector.

Manuel Norte Santo (third from the left) and the rest of the team behind Est. Manuel Silva Torrado

Manuel Norte Santo (third from the left) and the rest of the team behind Est. Manuel Silva Torrado Est. Manuel Silva Torrado is a significant producer and exporter of extra virgin olive oil in Portugal, with a long history and a global presence in supermarkets and restaurants. The company is working to change the export paradigm by investing in branding and promoting the high-quality Portuguese olive oil, with a focus on expanding into East Asian markets while also meeting the varied demands of consumers in different regions.

Producing and exporting award-winning extra virgin olive oil in Portugal is a delicate balancing act, according to Manuel Norte Santo, an export manager of Establecimiento Manuel Silva Torrado.

The company started in 1878 when Manuel da Silva Torrado, a merchant from Castelo Branco, about 185 kilometers northeast of Lisbon, went to the capital to sell olive oil in the city’s markets.

We cannot ignore the future, and if we do not plant at high-density and super-high density, with the lack of human resources we have in Portugal, we don’t have a future in the olive oil sector.

Since then, the company has become a significant producer and exporter with 200 hectares of olive groves, two mills in Alentejo, the country’s largest olive-growing region, and a global presence in supermarkets and restaurants.

As the company has evolved, so has the Portuguese olive oil industry. The combination of capital flight from Spain during the 2008 financial crisis and the construction of the Alqueva dam in Alentejo transformed the olive-growing landscape.

See Also:Porducer ProfilesNorte Santo, whose family owns and runs the company, became one of two export managers seven years ago and has seen the sector’s evolution firsthand.

“I experienced the big boom of Portuguese production,” he told Olive Oil Times. “Because of the Alqueva dam, many players came to Portugal and invested in super-intensive [super-high-density] olive groves.”

Historically, Portugal was composed of traditional olive groves. In the five years leading up to the crisis, the country produced an average of 37,000 tons of olive oil each year.

Since then, annual olive oil production has tripled as many high-density and super-high-density farms entered production. Portugal produced a record-high 206,200 tons of olive oil in the 2021/22 crop year, and Norte Santo expects the country to produce 150,000 tons in 2023/24.

Est. Manuel Silva Torrado has two intensive groves with Arbequina, Galega, Hojiblanca and Picual olives. A third super-intensive grove was recently planted solely with Arbequina and is not yet producing but will eventually account for about 30 percent of the company’s yield.

“We also buy a lot of olives from different producers to have the opportunity to have different varieties, and then we can make different batches and experiment with different blends of olive oils,” Norte Santo said.

The company buys Galega olives for the company’s mill in northern Alentejo. Norte Santo estimates that these make up about 80 percent of production at that mill. They also buy the traditional Portuguese varieties of Cobrançosa, Cordovil and Azeiteira, and Arbequina and Picual, the two most-grown varieties worldwide.

“But we mostly buy Portuguese varieties,” Norte Santo said. “We must guarantee a certain profile to our olive oils so they carry a Portuguese tradition and flavor.”

Norte Santo came to the company with a mandate to expand its export markets in East Asia.

When he joined the company in 2016, Norte Santo was mandated to expand exports beyond the traditional markets of Brazil, Europe and North America.

“We are trying to export this idea that Portugal has high-quality extra virgin olive oil because it has the most modern plantations, but we are a small country,” Norte Santo said. “We don’t have the tools that Italy and Spain have, so it’s not easy to export that concept.”

According to Norte Santo, many large Portuguese producers sell in bulk to Spanish and Italian brands, which blend and re-export the olive oil. He said Est. Manuel Silva Torrado is among the companies trying to change this export paradigm.

“It’s important to understand that we need to invest in the brands, invest in this concept that Portugal has amazing olive oil,” he said. “I think that we are making progress.”

Est. Manuel Silva Torrado has a long history of exporting Portuguese olive oil under Portuguese branding. The Saloio brand, which earned a Gold Award at the 2023 NYIOOC World Olive Oil Competition, was registered in 1925, with its Santa María brand established shortly after in 1927.

Norte Santo said both of these brands have a long history in countries with significant Portuguese diasporas, helping to establish the country’s extra virgin olive oil in some of the world’s largest consumers.

Different versions of Saloio are primarily sold in Asia and North America, while the Santa María brand is the company’s flagship oil in Brazil.

“We have a lot of history in countries including Brazil, the United States and Canada,” he said. “We came here with the Portuguese immigration that happened in the middle of the century. Our brands come with these people to those markets, and we are still very strong brands there.”

While working to maintain shelf space in these established markets, Norte Santo set his sights on the lucrative East Asian market. Shortly after arriving, he traveled to China and Japan, which consume a combined 100,000 tons of olive oil each year.

Upon his first impression, Norte Santo said there was a dearth of knowledge in both countries about its health benefits and how to cook with olive oil.

“There was a lot of knowledge that we needed to pass to the consumer about the product, then about our country, Portugal, and then we could present our brands,” he said.

Part of the balancing act of being a large-scale exporter is meeting the demands of consumers with highly varied expectations for the product. Norte Santo’s job is to identify which Saloio blends produced by the company each year are best for each of their main export markets.

“A lot of the year, our blends are not the same, so we need to identify which blends we can assign to different markets to satisfy different clients,” he said.

Norte Santo said East Asian consumers want “extra virgin olive oil with bitter and spicy notes. The blend we sell to these countries has to be very good and green, with many aromas and flavors that other countries don’t require.”

As a result, blends heavily based on the mild Galega, which Norte Santo described as “a soft olive oil, even sweeter than Arbequina,” do not sell well in China, Japan or South Korea, with a far more pronounced preference for blends heavy in Picual and Cobrançosa.

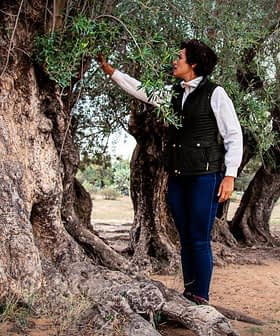

Est. Manuel Silva Torrado has two mills in Alentejo, with one mostly dedicated to transformign the local Galega variety.

On the contrary, he said North American and Brazilian consumers are looking for more delicate, sweeter extra virgin olive oils.

“The Portuguese community in the United States talks a lot about the Galega because it’s the most known Portuguese variety,” he said. “Americans like this neutral olive oil because it doesn’t directly affect some flavors when the cooking.”

Meanwhile, in Brazil, Norte Santo said being competitive on price remains the main focus, though this is changing.

“In Brazil, it’s all about the price,” he said. “They want extra virgin olive oil, and that is it. It’s a different market. People don’t yet view the quality of the olive oil like they do in the United States or Asia.”

He attributes part of this to fluctuations in the local currency, which makes it difficult for exporters to maintain a consistent price, and the long history of companies importing olive oil in bulk to bottle or blend with other edible oils and sell under Portuguese-sounding brands.

Back in Portugal, Norte Santo said the company faces entirely different challenges. Chief among them is finding enough people for the harvest and stemming the flow of young people from the countryside to urban areas.

“We have an old population, so it is difficult to identify groups of people willing to come to the plantations to do the harvest,” he said.

According to Norte Santo, the company has recently hired immigrants arriving in the country who are willing to do the work.

However, the immigrant workforce is highly transitory and may not return for the following harvest. As a result, the company has to train a new set of workers to harvest the olives each year, which takes time and resources.

Another challenge the company faces is an increasing resentment from local populations to the rise in high-density and super-high-density plantations in Alentejo.

Norte Santo said people who oppose these types of plantations cite a combination of their visual impact on the landscape, perceived use of water during times of drought and economic and social impact on traditional olive growers.

Norte Santo said the Portuguese sector must find a sustainable balance between traditional and high-density and super-high-density groves.

“Some people say that we are destroying the environment of Alentejo because we plant intensive olive groves,” he said. “This is creating political noise that is not good for the sector. It’s a challenge to explain to the people what we are doing, why we are doing it and the advantage of these types of plantations in the region.”

“They think we are using more water than we need, which I would say is not true,” he added, citing other more water-intensive crops, such as almonds, as larger water consumers than high-density and super-high-density olive growers.

“They tell us we are taking out traditional producers, but this is also not true since we plant in areas that do not have traditional olive groves,” Norte Santo said.

“Traditional producers are very important,” he added. We need to guarantee that we have the Portuguese identity and Portuguese varieties. We need to value these varieties. Indeed, we pay more for Portuguese varieties than Arbequina because they are rare.”

“We need to give value to those producers and coexist in the system,” Norte Santo continued. “We cannot ignore the future, and if we do not plant at high-density and super-high density, with the lack of human resources we have in Portugal, we don’t have a future in the olive oil sector.”

Norte Santo said social media helps feed some of these extreme positions and spread narratives that he believes are false about the role of high-density and super-high-density plantations in the region.

“It’s important to fight these extreme positions and explain the technical issues of the plantations surrounding water use and impact on the soil,” he said.

“There are consumers for all types of olive oil, for mass-produced Arbequina and Picual and traditionally produced local varieties,” Norte Santo concluded. “There’s space for everyone.”

Share this article